Buying a condo comes with unique insurance needs — and they all start with understanding condo master policy coverage. Your association’s bylaws determine what the master policy covers and what you must insure yourself. Get this wrong, and you could either overpay for coverage or be left underinsured when disaster strikes.

Why Condo Bylaws Matter for Coverage

Your condo bylaws explain exactly how condo master policy coverage is structured. They spell out:

-

Where the master policy stops and your coverage begins.

-

Your share of repair or replacement costs after a loss.

-

Responsibility for deductibles if damage originates in your unit.

-

How upgrades are handled — many bylaws only cover original finishes, leaving you to insure betterments and improvements.

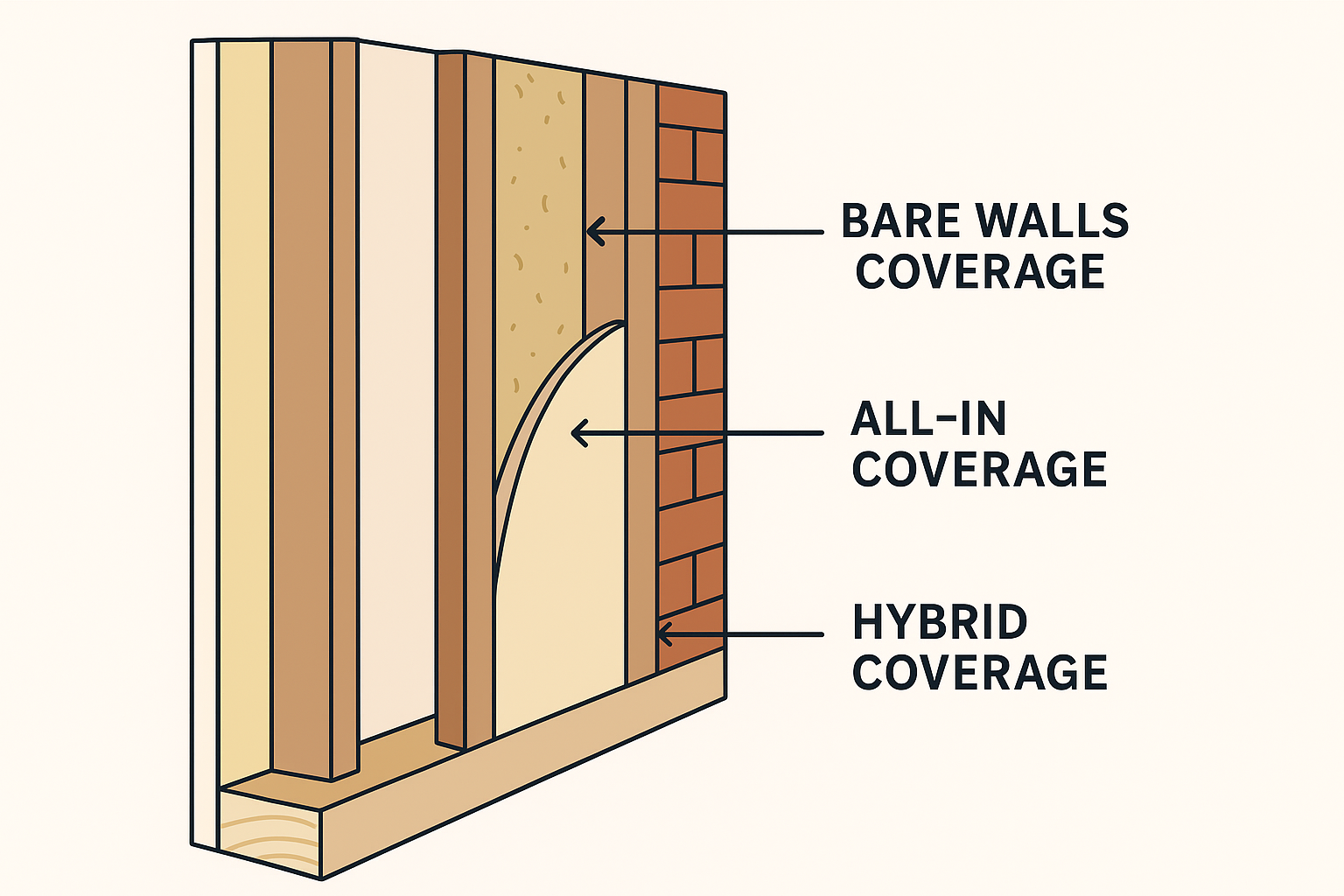

Different Types of Condo Master Policy Coverage

There isn’t just one standard way these policies are written — which is why your bylaws matter so much.

-

Bare Walls / Studs-Out Coverage – Protects the exterior and shared areas, leaving you responsible for everything inside from the drywall inward.

-

All-In (Single Entity) Coverage – Covers the original construction and fixtures but not your upgrades.

-

Hybrid or Modified Coverage – Many associations have a mix: they may cover drywall but not flooring, or include plumbing fixtures but exclude cabinets.

Knowing which type of condo master policy coverage you have is critical to setting your dwelling limit correctly.

Setting the Right Dwelling Coverage (Coverage A)

Once you know your condo master policy coverage, your agent can help calculate the rebuild cost for your share of the property.

-

With Bare Walls coverage, you may need $50k–$75k or more to rebuild everything inside.

-

With All-In coverage, you might only need $5k–$15k to cover upgrades and the association’s deductible.

️ Add Loss Assessment Coverage for Extra Protection

Even with good condo master policy coverage, associations can still issue special assessments to owners for deductibles or losses that exceed the policy limit. Adding loss assessment coverage is a low-cost way to protect against these surprise expenses.

✅ Key Takeaways

-

Read your bylaws carefully to know what your master policy covers.

-

Identify your condo master policy coverage type — bare walls, all-in, or hybrid.

-

Set your dwelling coverage limit based on what you’re responsible for.

-

Add loss assessment coverage for peace of mind.

Ready to Make Sure Your Condo Is Properly Covered?

Don’t guess when it comes to condo master policy coverage — one small gap could cost thousands. Our team at Customers First Insurance Group will review your bylaws and master policy, then recommend the right dwelling coverage for your unique situation.

Call us today at 586-221-6870 or request a quote online to protect your condo the smart way.